Getting The Offshore Business Registration To Work

Table of ContentsNot known Facts About Offshore Business RegistrationFacts About Offshore Business Registration RevealedThe smart Trick of Offshore Business Registration That Nobody is Talking AboutExcitement About Offshore Business Registration9 Simple Techniques For Offshore Business RegistrationA Biased View of Offshore Business Registration

Establishing a company offshore while it can be completed in just a couple of steps does take some study and also a person who has actually strolled this course before - offshore business registration. Offshore company registration though straightforward, is hard. Seeing to it you pick the right framework, in the appropriate country for your organization needs some careful consideration.

Keep reading to figure out the 5 ideal countries to establish an offshore firm. Materials Hong Kong, while a component of the Individuals's Republic of China, has a legal system that adheres to the English common law. It gives the greatest overseas business consolidation advantages among all other Oriental nations, from overseas company enrollment to taxation.

5% of the business's earnings in taxes. Residency is likewise not needed for offshore firm register.

Some Known Details About Offshore Business Registration

There are various other tax obligation processes here that will certainly profit overseas companies. These are much better discussed with an overseas company formation representative. Panama companies additionally have flexibility; they can do the exact same tasks as in the United States, EU, and Canada. They can purchase as well as have actual estate and also various other kinds of assets, like autos, private yachts, fashion jewelry, and also such.

The country supplies tax obligation exception for two decades for overseas business as well as shareholders. Firms only have to pay a set yearly cost despite their profit gains and also margins. It additionally has an International Organization Companies (IBC) Act of 1990. This act forbids details sharing to other nations. Consequently, it safeguards the privacy of offshore corporations in Belize.

The Ultimate Guide To Offshore Business Registration

Firms in this country do not have to release their accounts and equilibrium sheets. It takes just a couple of days for overseas company configuration, and also you will not have to worry regarding licenses, licenses, as well as such.

The Bahamas does not allow bank, betting, insurance policy, and also grown-up tasks (offshore business registration). The Cayman Islands is just one of the most popular locations of offshore hedge funds and offshore companies. The main reason is the 0% business tax obligation rate. There are no resources gains, earnings tax obligations, income taxes, withholding tax obligations, and also such. Apart from that, its offshore firm registration and renewal costs are reduced than in various other nations.

The Cayman Islands offers personal privacy to its firms, as well, as the public can't view the Register of Shareholders or the Register of Supervisors as well as Policemans. All various other company records are personal, consisting of the business accounts and conference minutes.

7 Easy Facts About Offshore Business Registration Shown

When you develop a company below, you'll get an Intra-Community barrel number. This is a lawful requirement for firms to do company with various other EU countries. You're not restricted way too much, over at this website too, as you have versatility in the firm framework. There's additionally no minimum funding requirements, unlike various other nations in the EU.

To be details, Cyprus has a tax obligation price of 12. What this means is that when you open an overseas financial institution account here, you do not have to share your financial institution account info.

There are essential records and also records you require to have, as well as you need to also have a good knowledge find more info of your accounts. If you require help with information handling in the United States, contact us today and also let's see exactly how we can help. Connect to our team today!.

Rumored Buzz on Offshore Business Registration

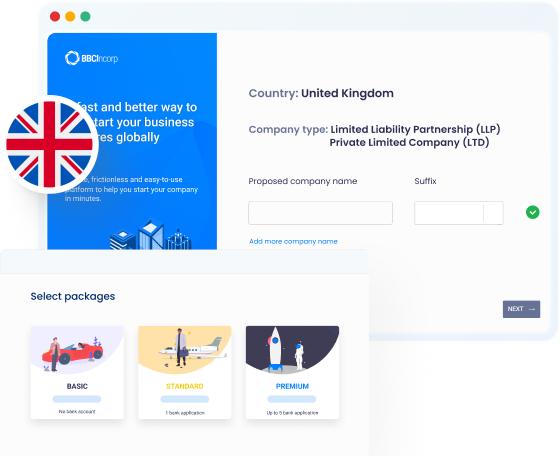

An is a firm that is signed up abroad as opposed to in the country where the operational business takes area and also the offices are situated. An offshore firm can be an intriguing design for a company. If you are considering carrying out an overseas design and are considering the UK, you need to keep reading right here.

Following its mandate on leaving the European Union, the UK revealed that it would be leaving the confederation. Since the British wishes to safeguard as numerous benefits (EU internal market) as feasible and also to take on matching responsibilities within the alliance, this contrasts the concepts of the EU and also there are for that reason troubles in the exit settlements, the effects of a Brexit are not foreseeable.

An Unbiased View of Offshore Business Registration

If you are incapable or reluctant to deal with these jobs by anchor yourself, we would certainly more than happy to recommend a seasoned tax advisor that knows with UK tax regulation. offshore business registration. The UK has a quick and also reliable registration procedure for. Firm formation can be processed online within a day.